Text | China, Europe, and Globalization in 2024: What’s Next for Business?

February 19 , 2024Host Organization: Center for China and Globalization (CCG)

Partner Organization: German Federal Association for Economic Development and Foreign Trade (BWA)

Format of Side Event: Luncheon/Roundtable

No. of Pax. 35

Date and Time: 12:00-16:00 | Monday, February 19, 2024

Venue: The Garden, Hotel Bayerischer Hof. Munich

Table of Contents

Roundtable I: Assessing the risk of “de-risking” (supply chains, technology, FDI)

Chaired by: Dr. Henry Huiyao WANG, former Counselor to State Council and Vice Chairman of MOFCOM China Association for International Economic Cooperation, People’s Republic of China; Founder of CCG

Framing questions:

➢ What does “de-risking” mean for business?

➢ How do companies de-risk? What are the strategies for dealing with geopolitical headwinds?

➢ Is fragmentation inevitable? What are the possible alternatives?

➢ What does the future hold for the CAI?

Mabel Lu MIAO

Henry Huiyao WANG

Michael SCHUMANN

Kenneth FREDRIKSEN

Stefan GÄTZNER

Klaus MÜHLHAHN

Thomas HUECK

Niels Peter THOMAS

Karl WEHNER

Ömer Sahin GANIYUSUFOGLU

Moritz ROLF

Johannes HARTL

Michael SCHUMANN

Heinrich KREFT

Mabel Lu MIAO

Co-founder and Secretary General of CCG; Munich Young Leader 2020; Member, The Chinese People’s Political Consultative Conference (CPPCC)

Esteemed guests, friends, ladies and gentlemen:

Good afternoon! My name is Mabel Miao and I am Secretary General of CCG. Welcome, all of you, to take your busy schedule to join us for this luncheon roundtable event co-hosted by CCG and BWA in partnership with the China Bridge. CCG is one of the largest non-governmental think tanks in China. We are one of the globally recognized think tanks as well. Since 2008, we’ve dedicated ourselves to the of studying China and globalization and China’s role in globalization. CCG also has a well known business council with over 100 council members drawn from multinational companies and China’s internationalizing sectors. We know that the trajectory of Globalization has been changing in the past decade, affecting global businesses all over the world.

Two days ago, we hosted an official side event in this building with the Munich Security Conference. Many people know CCG hosted side events with the Munich Security Conference in the past few years. This year, our theme was “China, EU, and US cooperation on climate change.” This is a very important topic for everybody. We know that this year’s annual report of the MSC is about “Lose-Lose?” But we know the spirit of business community is win-win cooperation. We have to achieve win-win cooperation.

So today, I think we are going to talk about these topics as well. We have invited so many distinguish guests to talk about that. Later we will have lunch, then we have the luncheon discussions, different roundtables with different themes. Premier Li Qiang’s says it all too well – “Failure to cooperate is the biggest risk.” “Failure to develop is the biggest insecurity.”

We believe that business itself is the real driver of globalization, and is increasingly becoming straitjacketed by the ongoing narratives of conflict and zero-sum game. Last year at the Global Solutions Summit in Berlin, we co-hosted a business dinner with the BMW Foundation. This year, we’re very pleased to partner up with BMA and China Bridge to host this event for the first time on the heels of the Munich Security Conference. We hope this event can herald more meetings and discussions between Chinese and European business communities in the future.

2024 is a consequential year for the world. We will remain committed to fostering pro-opening, pro-globalization public discourse for Chinese policy-making and welcome you to come to Beijing for our signature annual forum. Our 10(th) edition of China and Globalization Forum will be held on May 25-26. If you’re interested, please feel free to contact my colleague Dr. Tang. She is in charge of the program.

Last but not least, I would like to thank our partner – the China Bridge and the dedication and excellent work of its vice chairman Mr. Andreas Hube. Of course, Michael will deliver a keynote later, the boss of the BWA. We’re also grateful for the support of our partner Nio. We know Mr Zhang is here. Thank you for your support. We’re honored and privileged to have a very distinguished group here with us today. We thank you so much for being with us.

Without further ado, please join me in welcoming the first keynote speaker – former Counselor to State Council, Vice Chairman of China Association for International Economic Cooperation at the Chinese Ministry of Commerce, Founder of the Center for China & Globalization, Dr. Henry Huiyao Wang.

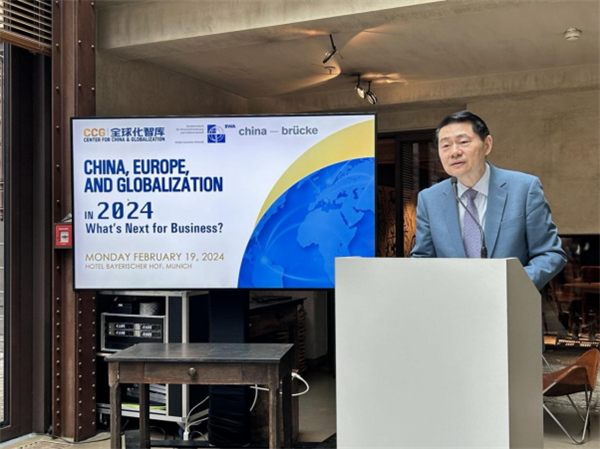

Henry Huiyao WANG

former Counselor to State Council and Vice Chairman of MOFCOM China Association for International Economic Cooperation, People’s Republic of China; Founder of CCG

Mr. Mike Schumann, distinguishing guests, ladies and gentlemen:

It’s really a great honor for me to stand here right after the Munich Security Conference finished. Last night and exactly in this hall, we had 50 key participants of the Munich Security Conference give a very good summary of what has been conducted in the last three days. And as you probably know, China actually had its largest delegation to the Munich Conference this year. The Center for China & Globalization has three participants, myself, Dr. Miao, and Dr. Tang. So we are extremely honored. We’ve been six years in a row participating in the Munich Security Conference. We are also the official partner for the official site events here – the only China think tanks to hold side events at the Munich Security Conference.

We thought it was a great idea to work with BWA, our partner for a long time. I remember during COVID, we were in Berlin. Michael and his colleague organized a roundtable in Berlin which was very impressive and we thought that it was a good occasion. While we still have many friends who attended the Munich Security Conference like our friend ambassador from Germany to Luxembourg before – he is here right now. And also we thought, you know, the Munich Security Conference is more about security, more about all the grand topics. But we would like to also zoom in a little bit about China-EU and China-German business cooperation. So we had a lot of business representatives at this table, and we’re very pleased to have a company representative from Huawei, from Nio, from ByteDance, and from many more. And we also have journalists from Xinwan News Agency and Phoenix and all the rest.

I’m extremely grateful that we have so many German and European friends here – I mean, some coming from outside Munich to attend this event – so we can really continue the spirit of the Munich Security Conference exactly at the same location to continue this more business-related venue. So I really felt very thankful for all of you to attend the event today.

I just want to maybe mention a little bit about the Director of the Central Committee Foreign Affairs Commission, China Foreign Minster, Mr. Wang Yi, who actually spoke a day before yesterday where we were the audience to hear. His speech this year has gained more support and was more accepted than, I would say probably, ever in the Chinese diplomatic speeches because this year we see the Munich thinking is less China-centric. I think in the last few years we had the pandemic, there were sanctions. But this year is more positive. The theme of the report of the Munich Security Conference is talking about “Lose-Lose”. As you all know, China has always promoted win-win, which means the win-win logic is there. If there’s a lose-lose, there must be a win-win. So how can we really display this win-win cooperation spirit? I think that has come back quite a bit to the Munich Security Conference.

This is very encouraging to see that we are the only two think tanks to hold a China-related event. CCG hosted together with the Munich Security Conference on China-EU-US collaboration on climate because this is probably the only foothold that we can really strive for international cooperation. I know MERICS organized another China-related event called “How to reengage China”, which also looks fine from the topic.

What I would like to say is that we hope that in the future, we’ll always have an occasion after the Munich Security Conference to have a reflection. And I’m sure after lunch, we’ll hear all the bright minds and views from distinguished guests surrounding this table this afternoon. So we will make a document on that and then we hope to reflect on some of that when we go back.

But what I would like to say is that, of course, China-EU relations and China-Germany relations are probably on an upward trajectory for 2024. I know Mr. Wang Yi met Olaf Scholz, the chancellor of Germany. But he also met the foreign minister of Germany and many counterparts of other countries. I know that he met Blinken, he met the Canadian Foreign Minister, the Argentinian Foreign Minister, and also the Ukrainian Foreign Minister, all here at Munich. It’s a very good meeting. Of course, Olaf Scholz is visiting China in April, mid-April, probably with a large business delegation. And then we have Mr. Wang Yi visiting France, probably preparing for President Xi’s visit to France with both countries celebrating sixty years of diplomatic ties. Also, he visited Spain, which is another key country in the European continent.

So I think there’s many more positive picking up of Sino-EU relations and hope that Sino-German relations will pick up again. And I hope that investment on both sides and trade will continue.

Looking at specifically the China-Germany foreign relations, I know there’s there’s actually a drop in trade for last year, in 2023. I think that was due to partly this kind of de-risking policy pursued probably blindly that is actually not helpful for the German economy and for the business community. The thing that we need to reflect [on is] how we can avoid a lose-lose situation because this is the new spirit of the Munich Security Conference, and then to set a new tune for the new development. But despite the decline overall, direct investment from Germany to China registered a 4.3% increase reaching €11.9 billion, which is great. I mean, the trade may decline, but the investment in China is still on the upside. So this surge in investment marked a significant milestone constituting 2.3% of German total FDI stock, the highest since 2014.

I’m sure Michael knows the data situation very well. I think the confidence of German companies in the Chinese market remains steadfast as evidenced by the Business Confidence Survey 2023/24 conducted by AHK Greater China. So despite the concerns about the Chinese economic trajectory, a staggering 91% of the surveyed companies expressed their intent to continue to do business in China. Moreover, 54% of respondents plan to increase their investment.

I remember when the German Foreign minister visited Beijing last year, the German embassy invited me to have a dialogue with the Foreign Minister. The Foreign Minister was with five Parliamentary members from different parties, along with several big businessmen from German companies.

I hear very clearly from the German business community speak to the 5 parliament members, that they have to be in China because China is in the heart of the state-of-the-art technology development upstream and downstream. And if a German company wants to be competitive in the world, they have to be in China to gain that competitiveness so that they can conquer the world market. And so, to be in China is not a matter of “in China for China”, but “in China for the world.” And they cannot afford not to be in China.

I also remember last November, I was invited by the German Parliament, by CDU to speak to the German Parliament where von de Leyen was the first speaker, European Council President. And of course, she talked about de-risking and all the things. But I heard my peer speaker together, the CEO of Mercedez-Benz. He was saying that, talking about de-risking, the biggest risk is not going to China. So that is the consistent voice I heard from the German business community in China.

Premier Li just said at Davos that China has 400 million people in the middle-income bracket and in the next decade in China, we’ll have 800 million. That’s the biggest market nobody can really afford not to be in. So I think as we’re seeing the news that President Trump will come back, and he’s threatened maybe not going to support NATO on the budget.

I think our European friends here, we have to continue our economic relations with China, and also probably welcome China’s investment here in the European market. The economic outlook for China, many will say, is China is slowing down or real estate crises and things like that. But I would encourage people to go to China to take a look. It wasn’t as bad as people thought, actually. I just came from there. You know, during this past China’s New Year of the Dragon holidays, 9 billion people traveled around China. Hundreds of millions or how many people traveled outside China. And so I think you can see China has recovered quite significantly. The property market used to contribute about 7.3% of China’s GDP growth. Last year, it contributed 5.8%. So it’s not crashing or anything. It was just slowing down. I think from high speed to high quality is what China wants.

Of course, on the other hand, China has the new export champion now, for example, the EV automobiles, the clean technology, the battery, and solar panels. During our roundtable at Munich, we have Niall Ferguson said he was quite surprised to see China’s clean technology has developed so fast, and that really helps to fight climate change.

Also, I have to say that conversely, China’s investment in Germany, has steadily declined since 2016 with only 26 reported cases of China investment in 2022, a stark contrast to 68 cases in 2016. So I think now with Olaf Scholz going to Beijing, we have to maintain this economic relations with China. It’s important that we still keep this investment channel open because there are a lot of German companies investing in China, why can’t we have more Chinese investment in the German market? So I think this is really important. You know, data from Deutsche Bundesbank revealed a sharp downturn in direct Chinese investment with a net flow of €2.3 billion in the previous year from a positive flow of €3.7 billion in 2022. So the widening gap between the investment in China and investment in Germany could be an issue. So we hope that there will be more support for the Chinese corporation in the German market.

Finally, I would like to say that this is really a great dialogue. We would like to seek your advice, your recommendations, and also your brilliant ideas on how we can sustain this economic cooperation and reflecting on the Munich Security Conference theme, how to avoid this lose-lose situation. In China, for instance, Wang Yi talked about a win-win. And I think that if we can work together, if you have a business voice expressed in this positive direction, I think in the New Year of Dragon in 2024, hopefully, we’ll usher in some new momentum for our cooperation among these geopolitical tensions. As foreign minister Mr. Wang said, China hopes to inject positive balance into the global scene.

For example, on big power relations, China can project a positive impact. China is the second largest donor to the United Nations’ regular budget and peacekeeping assessment. Hopefully, China can do more to maintain global peace. Second, China concluded the deal with Iranians and Saudis. China hopes to help more in the Middle East peace process. And thirdly, global governance, that is, to participate in climate change and in many global multilateral systems. I hope that China will continue.

Finally, China will continue to inject positive stability into the global economy. Last year, China achieved 5.2% GDP growth, which represents over 30% contribution to the world GDP growth. And Asia is booming with China, ASEAN, and RCEP. So we hope that the stability of Asia, which is the only place where there’s no hot war right now, will be very economically and politically still quite positive.

So we hope that we’ll continue our China-EU cooperation and China-German cooperation. And I look forward to hearing All of your very good comments. Of course, we’ll hear our co-host Mr. Schumann’s comment. We’re still in the New Year before the 15th of the first month of the Chinese New Year. So I would like to wish all of you a Happy New Year of the Dragon and bring prosperity, peace, and also help. Thank you all very much.

Mabel Lu MIAO

Thank you very much. The speech from Dr. Huiyao Wang, CCG’s founder. I think he analyzed the EU-China relations, the geopolitical issues, and the economic issues currently. So next, we are very pleased to have Mr. Michael Schumann, who is the Chairman of the Board, BWA. BWA is the German Federal Association for Economic Development and Foreign Trade. Warmly welcome, Mr. Schumann.

Michael SCHUMANN

Chairman of the Board, BWA; Chairman, China-Bridge

Dear Dr. Wang, dear Dr. Miao, distinguished guests, ladies and gentlemen,

On behalf of BWA, the Federal Association for Economic Development and Foreign Trade, I also have the pleasure to welcome you today to our joint event with the Center for China and Globalization. We are delighted that so many of you are joining us here in Munich. CCG’s events in the context of the Munich Security Conference have a long-standing tradition. Four years ago, at the 56th Munich Security Conference, you welcomed former US Secretary of State John Kerry to your roundtable. It was a different time back then.

Well, the 60th Munich Security Conference has just come to an end, and although everyone here has spent the last few days talking about nothing but security, the feeling that remains is one of lingering uncertainty. And if you follow the change in political rhetoric in Germany and Europe closely, you could sense that from the speeches and reports on this year’s conference, when you hear the ever louder calls for Germany and Europe to become “fit for war” again, you wonder where this is supposed to lead.

“Peace through Dialogue“ has been the motto of the Munich Security Conference for many years. However, part of a genuine dialogue is engaging with voices that challenge you and your beliefs, that at times may even seem like an imposition, that forces you to get out of your comfort zone. If you try to avoid this you run the risk of turning your dialog into an echo chamber. The increasing tendency of the Munich Security Conference to exclude unwelcome voices that advocate for peace instead of further escalation, including elected members of the German parliament, does not necessarily speak for the organizers.

But our topic today is: China, Europe, and Globalization – What’s Next for Business? So let me give you a brief outlook from our association‘s point of view: In 2024, we are facing a global super-election year with 4.2 billion voters, which in all likelihood will bring about major changes. After all, it’s the year of the dragon now, so better get ready for some of that dragon energy. The European Union and Germany as its biggest member state face a number of challenging disruptions that corporations must be aware of. Next to the war in Ukraine, we have an ongoing armed conflict in the Middle East, a looming escalation between Serbia and Kosovo, and a migration crisis that could create massive friction between EU member states.

In this environment, the European institutions aim to change guards with the election of a new European Parliament in June, resulting in a new European Commission in late fall and also a new leadership in the European Council. While the present term of the European Commission has been dominated by massive and far-reaching efforts to decarbonize the EU, a shift in the EU Parliament to the center-right could put the new focus on re-industrialization, job creation, and a path back to economic growth; plus tougher migration rules for the 27 member states. Yet, not only Europe is having elections. The United States of America also elects a new President, with potentially massive shifts in policy vis-a-vis Europe and Asia should Donald Trump get reelected.

During Trump’s first term, he refocused his country inwardly with an America-first policy platform, picking trade fights with basically every partner and ensuring that previously outsourced jobs came back to the US. In this, he perceived China as his biggest competitor.

Europe’s policies towards China nowadays can be summarized under the headline of “de-risking” its exposure to China. Despite the strong involvement of European companies in many sectors of the Chinese domestic market, politicians on both sides of the Atlantic are trying to redefine Europe‘s relationship with China from one of partnership to one of rivalry.

Against this backdrop, the current state of mind of many of our entrepreneurs, especially those who are involved in China or are still considering such involvement, can be characterized best by a growing feeling of uncertainty. Not a day goes by without them being confronted with contradictory news and reports. A few days ago, Reuters announced that German direct investment in China rose by 4.3% to an all-time record high of 11.9 billion EUR in 2023. But shortly before, it was reported that in 2024 the US will overtake China as Germany’s most important trading partner and that German companies should adjust their strategies accordingly. In early January, the German media went into overdrive conjuring up the end of the German car makers’ success stories in China, then earlier this month, in the light of significantly rising registration figures – Volkswagen sales in China went up by 43% -, they made a full turn around and predicted a positive year for the German automotive industry in the People’s Republic.

A mirror-image feeling of uncertainty also characterizes the mood of Chinese companies we talk to that are involved in Europe or are considering such involvement. You don’t have to be clairvoyant to predict that, against the backdrop of the current debates, the EU will take an increasingly critical view of any market penetration by potentially superior Chinese products. Nevertheless, there are also still opportunities.

The defining legislation of the current EU Commission has been climate change. More than 34 pieces of legislation were set on their way to reduce CO2 levels and become a net-zero continent by the middle of this century. These policies will bring about a massive uptake in renewable energies, which will be either used directly and most efficient or being stored as green hydrogen to decarbonize the steel, chemical, and transport industries.

Any company leveraging these shifts with its own products may even win the support of environmental NGOs and advocacy groups that are usually more critical of China. So the situation is complex.

But what can we do to counter this all-pervasive feeling of uncertainty? We advise our companies to largely stay away from the heated discussions in the media and politics and keep exploring their markets of interest, find out for themselves, get their own picture, and follow their own entrepreneurial instincts. At BWA we bring together entrepreneurs from Germany with entrepreneurs from different cultural backgrounds and match people who can ideally also do business with each other. And our focus here is on the people, with their respective cultural backgrounds and their respective cultural values; we do not lecture them and we do not bring together abstract entities, institutions, chambers, companies, but always very specific biographies with very specific concerns, to which we at BWA devote a lot of time.

We call that “Economic Diplomacy” and from the experience of more than two decades of doing this, we can say that this kind of “bridge building” work not only ensures growth and prosperity, it also promotes peace and understanding. And this is more important than ever in these times, because “everything is nothing without peace”, as our former German Chancellor Willy Brandt once put it. You are certainly aware of German Chancellor Olaf Scholz’s keynote at the conference that culminated in the statement: “Without security, everything is nothing”, it’s a variation of the famous quote by Willy Brandt. Two different leaders, two different generations. Willy Brandt witnessed and was shaped by the horrors WWII inflicted upon Europe. Olaf Scholz was born in 1958. I prefer to stick to the original version of this statement because even though, ladies and gentlemen, peace does not seem to be in too good a shape at the moment, one must not lose hope. If we want to secure a future for our children, there is no alternative.

Now, there are quite a few who, in view of the current crises and conflicts in the world, are telling us that the concept of economic diplomacy has failed and are calling on us, to only engage with friends and so-called “value partners”, who demand a stronger commitment to our “values” from our companies, who promote the hashtag “I stand with” as the one and only proof of decent corporate governance and investability.

We at BWA are not one of these voices, because we trust in our companies’ and our society’s own set of values, a set of values that – shaped by our history and culture – is much stronger than some people are currently suggesting. This year we will celebrate 75 years of the Federal Republic of Germany, 75 years of living in freedom and peace. Our values are strong and our companies carry them into the world. They need neither be hysterically defended against perceived and real threats at home and abroad, as this makes them smaller than they are, nor presumptuously exalted to become the sole guiding principle for others, as this inflates them and makes them inadmissibly greater than they are. But we should have trust in their power and their attraction, and it is, therefore, wrong to withdraw from economic areas that may appear problematic to us for various reasons. We are currently experiencing an escalating debate in Germany about investments by German corporations in Xinjiang. BASF and Volkswagen are at the center of this debate, and there is immense media and political pressure on both companies to withdraw from the region.

Ladies and gentlemen, I traveled extensively in Xinjiang years ago and saw the poor conditions in which people there lived. China had asked Volkswagen to invest in Xinjiang in order to create better job opportunities for the local population. And with all due respect for the commitment to human rights, someone has yet to explain to me how it helps the people there, who are supposedly at stake if you take those opportunities away from them. We need more commitment instead of less, we need more cooperation instead of confrontation, we need more exchange and understanding at the level of people who can relate to each other, even if they live in different political systems. And to come back to the motto of the Munich Security Conference: this is the kind of dialogue that will truly help to secure peace.

I hope that our event today can also contribute to this understanding, that you will gain new insights and make new friends and I thank you for your attention.

Mabel Lu MIAO

Thank you very much, Mr. Schumann, for the keynote speech from you. It’s wonderful. And I was quite glad to see there are so many distinguished guests — CEOs, executives, and senior people from multinational companies — who invest in China and who are going to invest in China in the future, I guess. I was at the venue of Wang Yi’s speech the day before yesterday giving a wonderful speech, giving feedback about many hypocrisies, including those just mentioned by Mr. Schumann on Xinjiang, on EU-China relations, on EV cars, on the new energy transition, and on a lot of those hot topics between the EU and China and our multinational companies care about and concern so much.

But I think it’s a very important occasion today. We need this occasion and more those occasions to have a kind of communication and understand each other. So that’s why I appreciate today our partner BWA. And the China Bridge – the name itself is an echo of our CCG’s values as well: China and globalization, how to gain more engagement between us. So next I would like to invite Dr. Huiyao Wang, CCG’s Founder, to chair our roundtable luncheon. But before that, we must have lunch. So please have the lunch first. We will start at 1:30.

Henry Huiyao WANG

I really appreciate the lunch we had together. So this is really a good moment to reflect after the Munich Security Conference. But I think the business community where we have a large group of representatives here today, by German companies, Chinese companies. I forgot to mention we also have, in addition to Huawei, NIO, TikTok, Alibaba, and Xiaomi — so the most advanced pioneer companies from China – but also a lot of German company representatives here too. So it’s really a great occasion to discuss.

So we have until four for our afternoon roundtable, which we’ve divided into two sections. The first one is really about: What does “de-risking” mean for business? And we have a few questions: How do companies de-risk? What are the strategies for dealing with geopolitical headwinds? Is fragmentation inevitable? What are the possible alternatives? What does the future hold for the Comprehensive Agreement Investment treaty between China and the EU?

So for this part, we have an hour and fifteen minutes. So we’ll start. We would like to have the company representative speak first. I noticed that we have Kenneth Fredriksen, Vice-President of Huawei European Region here at the table. Why don’t you start? We will leave each speaker 5 minutes so we can have more people to discuss. I really appreciate it that we can talk. So welcome, Fredriksen, to start.

Kenneth FREDRIKSEN

Vice-President of Huawei European Region

Good afternoon, everyone. I’m Kenneth Fredriksen from Huawei. I’ve been in Huawei for over 12 years now. So I’ve been, you know, going a very peaceful period of the decade we have behind this. And then the more turbulent of three, four, five years, I would say.

And obviously, I always approach de-risking from two perspectives. On the one hand side, the European-minded – by the way, I am Norwegian – So I come from a small country which is used to dependency on other large countries. So that’s one approach to de-risking.

But of course, then also from my more Huawei perspective as well, I see dangers and I also see a lot of confirmed challenges within this discussion from both perspectives. Obviously from our business perspective, de-risking has caused a lot of uncertainties because nobody really understands what de-risking means. It’s not defined properly. There’s a model talk about de-risking. So it has kind of created a narrative that more leads to de-coupling rather than a conscious way of managing risk, which is actually de-risking’s meaning and intention.

That brings me to my more European mindset. I believe de-risking is actually something very, very good for Europe. We should have de-risked a long time ago, to be honest, because nobody is sustainable or resilient if you’re too dependent on anyone. It doesn’t matter if you’re depending on a Chinese company or a Western country or a more Eastern country – this is a situation you wouldn’t want to find yourself in. So of course, from a European perspective, I think it is very important to really assess and define what we mean by de-risking. We need to do that from a more comprehensive and common way from Europe’s perspective to make sure that de-risking is not ending up with more risk, which I believe is the current path we are heading on.

So when meeting with customers and, of course, stakeholders, what we experience is that because of the uncertainty – how to understand de-risking – they are shying away from business with Chinese companies. But they also delay business in general, which is also causing another more fundamental problem for Europe. I think when it comes to our business digitalization basically, Europe is rapidly falling behind in digitalization because of the de-risking situation, because too many companies and also countries need to delay their investments because they don’t really understand how to maneuver and how to move forward in the current situation.

So that’s why I appreciate this kind of opportunity as well. I think the most important thing we can do as a business community is to convey the messages to politicians in Europe that, yes, the de-risking is, if it’s done correctly, good for Europe, but it needs to be defined properly and everyone needs to understand what is the purpose and the target of de-risking so that we can move forward, because the worst thing and the most risky thing for Europe and European businesses is that we are falling behind.

We are basically wasting time in trying to understand what to do because the rest of the world are competitive economies. They’re not stopping. They’re moving fast. And that’s what we can see now, the digitalization is slowing down in Europe as a result of de-risking, I think, and that causes also more long-term issues for European companies because they are becoming less competitive.

So from Huawei’s perspective, of course, we have always adapted de-risking in our supply chain and management. We have always had several sources of supply for every component. For all products to be allowed to move from an R&D concept to an R&D development stage, it needs to be possible to produce this product with at least two or three different types of components coming from different parts of the supply chain. We will not allow any product to be reliant on a single point of failure. And I think that is, of course, something everyone should adopt to their supply chains, also from a country’s perspective.

But we should also each differentiate between what has been stirred with this de-risking discussion, which is the Russian gas discussion. That is something very different because that is a continuous supply that is basically stopped from one second to another. Normal supplies on hardware and software are different. If you have a product in place, you have it in place. It doesn’t really stop me from using it, although there might be a situation that causes tension between the two different parts of the supply chain.

So I think de-risking is something, we as an industry, have a big responsibility of trying to convey these messages in a constructive way to decision-makers so that it ends up as a good thing also for Europe. Because in the end, if we are going to have win-win scenarios, I think transparency and also clarity about rules, regulations, the investment climate, and the business environment. These investments are supposed to be made carefully, especially in our sector where we are making investments for the next five to 15 years. Of course, you need to be sure that these investments can be used or are allowed to be used for that period of investment. Otherwise, they won’t make those investments.

So I think we can do something together by having a common voice not saying that de-risking is totally bad, but also, of course, bringing arguments into this discussion that make the politicians and the decision-makers understand the complexity and the importance of doing this correctly. I think that’s my point.

Henry Huiyao WANG

Thank you, Kenneth, for your good point of view. I think from a personal perspective, I think de-risking probably needs to be well-defined. I remember that Wu Hongbo. the Chinese government’s Special Representative on European Affairs actually said, de-risking [is like] when you have different lights – a red light, a green light, and a yellow light – and you don’t know what action to take. So I remember when Secretary Yellen came to Beijing last year, she talked about diversification, which I think is more reasonable. All companies need to avoid risk, but probably they’re talking about diversification. A company always needs to avoid risk and diversify. But when the government calls for that, it needs to well define it. So I agree with what Kenneth just said.

Next, we have an industry representative, the Chief Representative Greater China of BDI, Mr. Stefan Gätzner. We’re very happy to have him with us today. I’d like to hear from you as well.

Stefan GÄTZNER

Chief Representative Greater China, BDI

Thank you, Prof. Wang. I’m sorry for my poor voice. I got caught with a bad cough these days.

First of all, at the beginning of the New Year of the Dragon, Happy New Year! And I would like to point out a few points about de-risking, or better, simply diversifying strategies that German companies in the context of that changing perspective from China.

If you look at the recent investment statistics, like Michael just mentioned, we had last year new a record of investment from Germany – probably €11.9 billion are invested there. And in the last 2, 3 years, the U.S. has some really high [levels of investment from Germany]. So at first glance, everything seems to be well. But if you ask companies and they take a close look, you see some stress points. For example, according to the survey of the AHK (the German Chamber) – Michael already mentioned that number, I will put it in another context – 54% of German companies are willing to continue to invest in China Communist, but the number used to be about 60, 70%. So the investment trend is going down a bit.

And on the other hand, you are forced to overlook that those investments done right now, those big numbers are done by a handful of companies, big companies from Germany. And you don’t see too many new companies coming from Germany anymore. So a big stock of investment from many companies, but no newcomers anymore.

That all has to do with the changing perspective of German companies on China. What lies is this: we have this changing perspective on China. I would like to point out two pivotal points. The first is, of course, the COVID-19 pandemic. If you look into global supply chains, at the heart lie sourcing production capacities in China. The disruption of this highly efficient, but also over-concentrated supply chain behind the capacities by the pandemic has made one thing clear, for all critical resources at least. And for our products, a selection of geographically differently dispersed sources is necessary. The more you can diversify geographically, the better. And only if you diversify geographically, for example, Eastern Europe, Asia, and so on, the whole network of supply chains will become more resilient again.

And secondly, maybe more crucially, is Russia’s war and Russia’s aggression against Ukraine. A lot of the full-scale invasion two years ago demonstrated to many German companies and European companies the need to reduce risks and dependencies when dealing with authoritarian states. And if you consider China’s geopolitical ambitions, the question of Taiwan and escalated urgency of Taiwan, if the mainland is exerting its means to try to reunify with Taiwan.

So in German companies, for the first time, really started to consider extreme scenarios that we’ve never known before. And as a consequence of this new look at China, that new perspective has also reinforced the realization by multinational companies that hopes of trying to make changes in China’s economic system towards a real market economy have always been unrealistic. The upsets in market access and lack of fair competition have always been a continuous feature of China’s state and hybrid economic system. So that has become clear and of course, companies adapt to this.

Another fact which comes is the state’s loyal obsession about autonomy and security: Data legislation, which is really hefty for many companies; and another, for example, this last year’s anti-espionage law. It has been placed before, but it has been revised and it excessively expands the scope of espionage offenses. And as I was in China at that time, we really could fear that its target was foreign companies and the expatriates there.

Now what are the consequences of the changing perspective? The drug companies who have been investing in China – and many companies have been investing for decades now – face a multi-dimensional strategic dilemma.

●Firstly, the recent slowdown in China, the sluggish domestic competition, and the defense of overarching market positions – this applies especially to industries who are highly dependent on the Chinese market.

●On the geopolitical side though, companies must go with this trade conflict between the U.S. and China which forces them to address trade force and to look for alternative investment locations. And prior to this, the rising requirements of German and the EU extensions, for example, the recent German supply chain law and the restrictive legislative proposal which discuss how the EU maybe won’t come for the timing.

●Compliance in China might lead to repercussions like state-orchestrated consumer boycotts. We have seen that before in 2021. And then on the context of Xinjiang cotton, where the European and the U.S. consumer brands were boycotted.

●The toughest trial, of course, is potential military conflict in the Taiwan Strait. And something extreme – as I would consider extreme scenarios – this could imply consequences by being forced to close plants and stop present activities and lose investments like German companies faced in Russia, 2022.

So how would drug companies cope with these changes? There are some strategies that are following now.

●Many drug companies are now adjusting their strategy and some are increasing localizations of existing investments and doing more marketing to secure that position in China and to sign on their position in China.

●Others are trying to re-diversify into alternative markets for sourcing as well as for investments. Some companies are starting to separate supply chain systems on operating in China, avoiding risks above. So we can say despite the unique advantages of the Chinese market with its huge market and industry clusters and well-established supply chains, German companies are now also pursuing China+x strategy.

●Another shift is an increase in inventory. Since the pandemic, manufacturing companies have started to stock up on critical raw materials and contingency goods. Of course, there are consequences to this in the end. All this build-up in logistics, transport, and storage is to higher expenditures, and this applies pressure on company profits or an increase in the prices of the goods.

Just to wrap it up, in the foreseeable future, China will be an extremely condusive to professional creation as well as the sourcing sales market for drug companies. However, from many business leaders’ perspective, the market’s risk-rewards have changed and new balances to be found between resilience, efficiency, between investment security and internal investment. Thank you.

Henry Huiyao WANG

Thank you, Mr Gätzner. It’s a very comprehensive report on the EU’s views on Chinese opportunities. I agree with your conclusion that this is a very resilient market and still attracts a lot of trade and investments.

You mentioned Taiwan. I think I just want to add that Taiwan has just gone through the election in January, and then there wasn’t really any big uprising or any big disturbances. China actually always wants to promote peaceful reunification. As Foreign Minister Wang Yi said, there was a hype on Taiwan as if the Chinese mainland wants to take over Taiwan, but that’s not really what is happening. I think the election also has diversified Taiwan’s parties. There are two opposition parties now occupying a majority of the House, which is pro-unification. So I think the situation in Taiwan could be more stabilized.

The other thing is, you mentioned Xinjiang. I heard also from Michael that BASF and Volkswagen have been having problems producing in Xinjiang. But first, Minister Wang Yi actually mentioned at the Munich Security Conference – he gave a lot of statistics on Xinjiang. He talked about genocide, that the population of Xinjiang grew from 2 million when the People’s Republic of China was established to 12 million, and they can’t see a genocide with such a big population growth. And then the life expectancy has doubled, more than doubled, now has averaged 80 some years in Xinjiang. And also the GDP has gone up many times. So he welcomed anybody to visit Xinjiang.

I noticed the Munich Security Conference Chairman Christoph Heusgen said, okay, I would like to go. And Mr. Wang Yi said, welcome. So I think things could probably gradually get cleared up. And I’m sure if you go to Xinjiang now, you’re welcome and will be properly facilitated to visit. So that was just to make a point, but I agree with you that there are still a lot of difficulties, but we hope that as China gradually opens up, we’ll improve in understanding and solve those remaining issues of concern.

Now I’d like to have also Prof. Klaus Mühlhahn who is the President of Zeppelin University, a great friend of China also. I know you traveled two hours to our event. We had a very good chat this morning. So Klaus, why don’t you say a few words?

Klaus MÜHLHAHN

President, Zeppelin Universität

Thank you very much, Henry. I’m really happy to be here. I have to apologize. I don’t have to leave right after my remark because I have a very important meeting that I need to go to.

What I would like to do here is highlight a little bit of the bigger picture of de-risking. I think if we think about the term “de-risking”, then of course, we know where it came from – it was invented in Europe as a softer version of decoupling. The Americans started to talk about decoupling and then sort of a softer version was put forward by von der Leyen and that’s called de-risking. But we know the direction that it’s going. I think it’s difficult to save the term because I think the term implies that in the end, it will be a gradual decoupling because I think that is what’s really behind it. That’s my opinion.

But this is one thing. The other thing which I find dangerous about this term in the way we use it, “de-risking”, is that it’s also almost exclusively focused on China – like it implies that China is the biggest risk that we face. But my question is, when we talk with businesses in my area, in Baden-Württemberg, what are the biggest risks that we face actually? And there are risks that we can only face if we work together, for instance, China and other countries. And do you know the list of these words? Climate change, of course, and I think it’s been discussed already. But the other risks, for instance, an increasing gap between rich and poor in the world that fuels many conflicts and instabilities – just think about Yemen and what’s happening and the threats it poses for global shipping lines and so on. This is unsustainable.

We live in a world where, I think, events like the Munich Security Forum often – because they use the older terminologies and the older concepts – miss the reality that we live in a world that is non-sustainable. Neither if we talk about climate change, but also not disperse these huge differences between regions and within societies between the rich and the poor. As a historian, I’d say it’s an illusion to think that this will not result in something. It has always in history. This cannot go on forever.

But there are also other really grave risks. For instance, think about technological development. Technological development, especially in terms of AI, can produce huge benefits – no doubt about it. But I was in China three weeks ago and I was really moved that I talked to a leading computer scientist and he told me in terms of artificial intelligence. Man, this thing’s dangerous! We as a world community need to sit together and come up with rules. We want to use it and to harness it, but we also need clear rules. And these rules will not work if they are only established in one region of the world and are not rolled out globally.

So this is also a huge – we don’t know what’s happening and we are sort of blind – problem. So I think we need a whole new way to think about the changes that we have. And therefore, de-risking in terms of China is so dangerous because it gives us the illusion that China might be our biggest problem, but the biggest problems are elsewhere in the world. And we can only address them together.

And I’m not saying that there are not differences between [Europe and China]. We have different systems, and that’s fine. We have different cultural conditions. That’s also fine. But we need to face these things together. So I often think that if we cannot come together also on the intellectual level and create a platform where we come up with a better vision for the world (and I also do think there’s something right to it), the institutions that we have, global institutions, let’s face it, it’s not only extreme rightists who criticize them and say they are not working – they are really not working. They’re not working well. They’re not working well enough.

So I think if we are under the dream that just keep doing, the way we did in the past will work in the future, I don’t think that’s going to happen. So that’s my two cents here. Thank you so much.

Henry Huiyao WANG

Thank you, Prof. Klaus Mühlhahn. You are the president of a university well-known in Germany and you have just been to China. So your reflection is very important. I agree with you that the risk of climate change is probably the biggest risk. And if the risk is only focused on the risk of China, that’s probably misleading and may not be a right way to approach that. So thank you for your for your comment.

So now we have the lead discussion, we can open up for our roundtables and anybody to talk. I see we have a German business representative, Thomas Hueck, Chief Economist of Bosch. Maybe you can share some of your thoughts because when I was speaking at the German Parliament, the Mercedes-Benz Chairman was talking there together with me. So I’d like to hear from the German industry.

Thomas HUECK

Chief Economist, Bosch

Firstly, I only can underline what had been somewhat romantic. But the big problem is – and I know economists – the economists tend to believe that trade is the best thing you can do.

You’ve heard, of course, of distributing income disintermediated but apart from that, free trade can’t relieve anything. That’s naive if you are an economist. Apart from that, it’s a truism to clearly understand that if you’re globally active, you have to establish more regionalized supply chains; you have to be close to your clients. EU suppliers should be close to the production facilities, otherwise you might run into big problems. There are a few areas where we can’t do that. Semiconductors as well as these expensive LCD displays and a few other electronic components.

The problem here is that politicians tend to interfere with economics. It varies in levels, by the way. And from the economist’s point of view, that’s always bad. I’m old enough to understand that I have to accept reality. Politicians or politics have changed in the last decade – honestly, it’s two decades – which has much to do with the rise of newer superpowers, for instance, China.

That is something we in the Western world have not actually realized today. You know, sometimes we see huge achievements of the market on multiple occasions, we initially turned to ignore and then came back on the table in quite an odd way. And it’s, honestly, I wouldn’t say that’s a fault of China, or a fault of the U.S., or a fault of the Europeans; it simply happened. And that’s to the fury with our business right now that’s spreading multiple dimensions. So the best companies can do is to adapt and adjust accordingly – that’s what companies are good at.

The only thing I would argue is we need a better understanding about how the cooperation of corporations globally will look alike for the next five to ten years. That again is a little bit late because I can’t say that today with clear tendency, but we do already have a few, many years. As was mentioned, climate change is one of those areas where we can achieve some kind of common understanding. And insofar as these new rules that you mentioned before as well – which are important – are agreed on to some extent, it’s getting easier for companies to adapt.

Would it be as sufficient a mode as we had hoped for? Of course not. Any deviation from free trade incurs costs. That’s a kind of tax levied on business activities that is not going away, independent upon, by the way, who will be elected President of the United States later this year that will make such a big difference to economics.

And at the end of the day, economists, we are good enough to understand that you shall never put all your eggs in one basket. You have nothing that’s trusting your own, one of the first courses of economic theory. So, putting everything together, we can complain a lot, if Good morning, us. So we should make all the best of it enough quickly and we must be agile enough to address our processes and ensure our investments accordingly.

Last reminder of that point, talking about China, the EU, or the U.S., these three large regions inhabited by 400 to 1.4 billion people, it is naive to assume a global player who can forego one of those three regions for doing business. So if politicians are asking companies to either refrain from or to refrain from the U.S., that won’t work.

Henry Huiyao WANG

Thank you. So we’ll open the floor to anybody who’s interested. I know that the president of China Springer Nature is here. You live in China and you work with one of the largest publishers in the world. We collaborate with Srpinger very successfully on many books in China. So we’d like to hear from you as well.

Niels Peter THOMAS

Managing Director Books, Springer Nature

Thank you very much, Henry. I don’t want to make any commercial break-in here, but we publish a lot of books from CCG so that makes sense. You don’t have to pay to read and they are really very good. So I can only encourage you.

I’m an academic publisher and I would like to extend beyond that closely, if I just may because I think if we look at it from a scientific perspective, if we look at it from an academic perspective, decoupling from China means not de-risking but means a significant risk for our own academic and scientific system.

China has last year overcome the U.S. as the biggest supplier of new knowledge in the world. And there are many disciplines, especially the applied sciences – not so much in the humanities and the social science – but on average, there are many disciplines where one-third or even 40% or even more of new knowledge comes from laboratories in China that are all published in peer-reviewed English language international publications. So really reducing the number of academic cooperations and also reducing the number of innovation cooperations on a corporate level would significantly risk our own academic research capabilities. It’s not anymore the other way around.

So this is, I think, a very important detail. Just in the last couple of years, there was this tipping point of China being really needed in many disciplines. And not only in this room, but in many other discussion groups, people will always say, yes, this is about quantity, but look at quality. I just want to point out that the average article published in an international English-language journal is cited over average by other researchers in the world. So if you take that – well, in academic circles, this is a debate that’s a very big argument – but if you take citations as a quality measure, for the quality of an article, then the output of Chinese researchers is over the world average. And it has come a long way in the last couple of years, continuing to grow, we see the difference among changes. So this is really important.

But the interesting part here is also that the number of academic collaborations between Chinese and foreign researchers has been in decline since a couple of years ago. That might also be a pandemic effect, but we have to be very careful with also political effect. That is the real risk that I see on the academic side, which we really have to counteract. Otherwise, we will be facing more academic issues, in many corporations but also in the research model of the world, which is a serious issue.

Henry Huiyao WANG

Thank you, Neil, for your very firsthand and also data-driven explanation of how more important we human beings collaborate together, rather than decouple or de-risk, which is really against the universal laws of cooperation. So we would like to hear more from a representative of business, Alibaba or Xiaomi. And I don’t know if anybody wants to talk and we will be happy to hear.

Alibaba. Yeah, we have Mr. Karl Wehner, CEO of Alibaba Group in Germany, Switzerland, Austria, Eastern Europe, and Turkey. Big territory for you.

Karl WEHNER

CEO, Alibaba Group (Germany, Switzerland, Austria, Eastern Europe, Turkey)

Thank you for having me join this round. And it’s really interesting to see that we’re all pretty much aligned with here in terms of the possible right things to do.

You know, from Alibaba’s perspective, what we’re focusing on predominantly in the DACH region – Germany, Austria, Switzerland – is to help small-and-medium-sized businesses trade internationally using technology. So we are not a manufacturer, we are not a retailer, we are a platform economy that brings buyers and sellers together. So trading partners find each other on the platform and especially on the EU platform.

So when we speak to small-and-medium-sized businesses, when we reach out to them as Alibaba, they don’t care if you’re Chinese originally – the company. What they care about is the situation they are in and how to find cost-efficient ways of growing business. I think businesses around the world have always thought about not putting all their eggs in one basket, and I don’t like the term “de-risking” because it’s got a negative connotation to it. But all of these small-and-medium-sized businesses are saying we want to extend, we want to use technology.

But what we also hear is a high level of uncertainty. And that’s – if you look at the supply chain – highly debated in Germany, brought to life, not considering the consequences, naively thinking that it only affects companies of the size between 3,000 and 1,000 [people] – really naive if you’re thinking that. And this uncertainty slows economies down.

But German companies are anyway not the ones that are known for being – I don’t wanna say “fast” because that’s the wrong term – but taking risks, be bold. And in a situation like we have right now – that’s where a government or geopolitics are creating uncertainty – it just becomes more and more difficult to actually take action and to have that leap of faith against maybe a government saying, look, try and diversify. This is like your parents saying, don’t touch the hot plate on the oven, right? Everyone knows that. But then it also lingers with the companies in terms of, do I have to do this? Shall I be doing this? But then I don’t have guidance, and that creates uncertainty. And will business be sustainable if I grow my businesses internationally or towards China?

So from that perspective, I think it’s most important for all of us over here to actually articulate this to our relative authorities that creating more uncertainty is not the solution. Businesses need certainty and then businesses will flourish. You create more and more uncertainty, you create more and more fear. You tell businesses which countries are good or bad for you – first of all, it doesn’t work, right? Like we heard today, the investments in China are ramping up even with BASF having these issues. The big multinational companies in Germany do seek to grow their investments in China and abroad because there’s so much uncertainty in the local government, there’s more certainty going to the U.S. or to China in terms of subsidies. Right there, I’ve got to beef up my bank account before even starting building my plant. In Germany, we have to discuss for 10 years and the result is that Elon Musk comes to build and it was what everyone wants to do. So this is really, again, what I think we should all be vocal about, creating certainty versus uncertainty.

Henry Huiyao WANG

Thanks, Karl. I think you highlighted very well. I think you talked about Elon Musk. I remember Elon Musk came to China and then he built a Shanghai plant and then he became the richest man in the world because half of Tesla’s EV output comes from China. A lot of EVs coming from Tesla can’t export to Europe because it was all counted as China exports, but the money is made by Elon Musk. So I totally agree. I think that’s exactly the purpose of this roundtable. We want to have a business voice in business language. And business language is very simple. You know, we share the same principle, whether it’s German, Chinese, European – it’s all the same. That voice is seldom heard these days. So it’s great and I’m very grateful to hear those truths, frankly. So any German company would like to further comment and talk?

Ömer Sahin GANIYUSUFOGLU

QIAP Industrial Development Consultant, Qingdao International Academician Park

My name is Ganiyusugoglu, a very rare name. I’m a native Turkish. I have a German education. I am already 50 years in Germany and educated in Technische Universität in Berlin. My focus is machinery, industry, production, technology, and so on. And so smart factories and all that. We’re here today. I work for a German company. For sixteen years, I was the Managing Director of a leading Japanese private-owned company in Germany and Europe. And for 18 years, I have lived in China, in Qingdao, latest. 我是半个中国人 [I am half Chinese]. I’m awarded the Friendship Award of the central government. I’m a member of the German National Academy of Science and Engineering and I’m also a member of the International Academy for Production Engineering. I will go tomorrow to Paris for the annual meeting where we’ll meet all the professors and all academicians from all over the world for academic purposes. With this background, I want to make my comments.

For 18 years, I’ve been living with my wife in China with all my history. Today, looking around the world, “What is happening?” my wife says, “Can we live on in China? Because we feel today China is the best place for living in peace, for living with good perspectives for the future.

For example, we are talking about climate change. Climate Change is one of the aspects of the Sustainable Development Goals of the United Nations. And there are 17 Sustainable Development Goals. When you watch one by one individually, the country which contributes most to Sustainable Development Goals is China. One of the goals is eliminating poverty – China best design. Climate – China best example which the country contributes also financially to climate change. And so on and so forth, including Xinjiang.

I fully agree with you what is happening in the positive sense here. So looking entirely, I’m saying why I’m not 30 years younger to stay more in China and to contribute.

Then another aspect, academic contributions. After tomorrow, when I meet maybe 300 professors from all over the world, also from America, a minimal half of them are Chinese, contributing to American academics and industry. In England, many professors are Chinese in the publications – I really agree with you; I’m part of it – and many academic work is coming from China.

Furthermore, de-risking. Mr. Schumann has a good verdict. De-risking is not only a political issue. De-risking is coming from the bank business. What is our risk when we grant a credit? This is de-risking. This is financial wording. So the German Chamber of Commerce head in Beijing Mr. Hildebrandt says, de-risking is nothing the politics has to teach us. There is common sense in industry, ja? Don’t put all your eggs in one basket.

So, and finally, I think Germany and China have the best precondition for collaboration in the future. Germany sells mechanical gears; German machine’s best. And China sells digital gears and sets for business how to speed up – “China speed”. So when we cooperate, we can make 1+1=3. We can contribute globally, ja? So these are my feelings and my thoughts and I always say, why I’m not 30 years younger?

Henry Huiyao WANG

You didn’t miss anything. There’s still time. Great to hear from you.

Moritz ROLF

Vice President, Sungrow Europe

My name is Moritz Rolf. I’m the VP in Sungrow Europe here and based in Munich.

Chinese manufacturers of power electronics are one of the biggest manufacturers in the world, apart from Germany. But I actually want to give you the perspective from the business side, what it actually now means by de-risking because we are most detective from the solar industry, probably one of the biggest development factories competing with 100. We talk to friends and media and I see solar energy is a very, very political topic. And so we already feel how politics is in the field of business now.

The focus at the moment is on solar modules. We all know that for most of the raw materials for all the solar modules, 95% of solar modules coming to Europe are imported from China. And the reality now is that the European Union wants to protect the few solar manufacturers that are still existing. If you ask anyone in the industry, they would say you should be safe; you should have done it 10 years ago, maybe 15 years ago; and today is the day. I don’t want to go into politics, but the last government, 15 years ago, should have not let all these solar module manufacturers that still were existing sort of going out.

Now we have a situation that we have in Europe a total of 7 gigawatts module manufacturers left. We installed last year in Europe 54 gigawatts or so. How is the whole energy transition going to happen for 7 gigawatts of modules? And you’re not going to build 54 kilowatts of modules in the next few years.

But it’s political now that one of the last module manufacturers in Germany is based in Saxonia. There’s gonna be an election in September, which will put a timeout on the module manufacturer from bankruptcy in a year where you have an election. We now learned last week there will be a new regulation from the European Union – the Net-Zero Industry Act which is supposed to support and protect the last module manufacturers left in Europe.

So we are seeing international business in order to support these module manufacturers. It makes sense to me.

And I understand that resilience and de-risking are important. I’m European as well, but I think it needs to be the right way. It’s not just to say, okay, we have cordoned off Russian oil last week; we don’t have Russian oil and gas anymore; we now need to be careful that we don’t rely on China from the solar side, the new energy side. It’s correct, but it needs to be done in a way that the business and the energy transitional conditions still work. It’s just, through the experience-sharing of what we’ve seen, nothing particular to the industry’s problem follows this way.

Panel infrastructure, for example, we had situations obviously different, but it does have an impact. And obviously, just the other day, all of them said the solar industry and the energy transition would not be where it is now without the Chinese manufacturers. And that’s utterly clear without Chinese modules, without Chinese inverters, and everything else, we would not have the amount of solar installed in Europe – impossible.

The last 15 years, we’ve been working for some seven years. I was at a German development factory before. We’ve all done great business with the Chinese companies – all the stakeholders, all the customers, installers, students, large project developers. It was a great business relationship. But you can notice now there’s insecurity from all these customers. They don’t know what to do. Should we continue to rely on Chinese supplies? Do we need to look for European [ones]? Most days, none are European, what are we gonna do?

Henry Huiyao WANG

Great. Thank you. I want to thank our partner, BWA. We have such a group of representatives of the industry from both sides, both countries speaking with similar views, which we feel very interesting. Maybe you could have another business representative. I see Johannes Hartl, Head of Government Relations, Xiaomi, is here. If you could share something, I believe.

Johannes HARTL

Head of Government Relations, Xiaomi

So kind of a little spoiler, I’ve only been with the companies for 6 weeks, so don’t expect too much of my answer.

First of all, since I’m kind of late in speaking, I second whatever he said. One thing that I would point out is that some of the de-risking will probably be done for us. So somebody mentioned the German Lieferkettengesetz [Supply Chain Act], which some people already call pretty hardcore, which will now be doubled or tripled by the European Union in most of the CSDDD (corporate sustainability due diligence directives). And that will actually have also social liability from individual point implications. So the European Union has kind of forced us to de-risk.

That said, Xiaomi Technology Germany will be in scope as will any other German company that meets the size criteria. So we’re all kind of in the same boat. And probably following the news about the German Free Democrats trying to – I’m not sure – whether to say yes or no to the law, it would have even other implications if the European Union really decides against it because then Germany will be left apparently with the Lieferkettengesetz, which is the strongest in the most stringent in the world.

So in trying to end discord, it said over and over the level playing field on the European Union side, I see how different association articles in favor of and against it. But the reality is, I guess we kind of just have to deal with it.

But the good thing is – if you wanna point anything with that – every company, regardless of whether this company is based in Germany or a German company that will source out of China, we will have lots of stuff that we have to care about with respect to our supply chain. And that’s gonna be pretty hard because I understand everyone’s saying we have lots of time costs that will actually at the end of the day, make products more expensive. But that’s what we have to deal with and face the realities of de-risking making its way from politicians to tangible outcomes. We have to produce formal reports, sourcing, and looking at what’s happening in the supply chains in the world. So pretty tough times I would say.

Henry Huiyao WANG

Thank you for your sharing views. I’d like to hear also Michael, Chairman of the Board of BWA. What are your views on those issues? You are constantly in contact with businesses on both sides and are very knowledgeable on China-EU relations and China-Germany relations. So probably you could share some of your perspectives, Michael.

Michael SCHUMANN

Chairman of the Board, BWA

Well, thank you very much. I think I can confirm what has been said before about how German corporations and company owners currently feel. I would also like to come back to what was said at the beginning about the very meaning of the word “de-risking”, which I think was a very poor choice and which I would hope that we could move the earth and discussions away from the term.

I heard quite often those who describe themselves, saying, hey, de-risking is so cool; that’s not decoupling; we came up with a soft term. Has anyone thought about what it actually means to 1.4 billion Chinese being labeled “at risk”? If you look at the connotations from [the perspective of] financial industry, what does a financial institution do? It evades risk. They search for money laundering, and fraud and shut down those accounts. And I traveled China extensively last time for 42 days, this is what I have constantly heard.

So I think it is very, very poor judgment to use the term. We could have talked about resilience and I’ll have a European resilient strategy. We could have talked about having a German resilient strategy. Yes, we have a National Security Strategy and a National Resource Strategy, etc. – become more resilient by reducing risk from China, from Russia, and from the U.S. And everyone has forgotten that the predecessor of Ms. Baerbock, Heiko Maas, German foreign minister from the Social Democratic Party, called that, a while ago when Trump was still in office, we need a U.S. strategy/America strategy in German foreign policy. We might need one again if he gets elected.

So it’s a term right now that has actually inflated and is all over everywhere. But we have some responsibility in the language that we use, and I would hope that other institutions of the German economy would shift the debate to talk about resilience and less about de-risking.

Henry Huiyao WANG

Thank you very much for a really wise comment, which I think needs a lot of deep thinking and maybe some paradigm shift. Maybe you could hear a friend, Ambassador Henry Kreft. He was a former German ambassador to Luxembourg. He’s still in the German Ministry of Foreign Affairs, and a professor at a university in Budapest on diplomacy. Maybe you could share your views. You also watched China for many years as an expert in China. Please, Ambassador.

Heinrich KREFT

Professor and Chair for Diplomacy, Andrássy University Budapest; former German Ambassador to Luxemburg

Thank you very much, Dr. Wang. Well, I’m of course not a businessman and not working in the field of the economy, but I have worked initially in the German Foreign Ministry, also in this field. I’ve been head of the economic section of the Embassy Tokyo and also in Washington, D.C., so two of the major economies. And I have been for 30 times to China.

I would like to echo what Prof. Mühlhahn said, that we should be careful about what we are talking because this could become a self-fulfilling prophecy. It has been set around this table that this term of de-risking is a softer term for decoupling. It was actually the reaction of Ms von de Leyen to the U.S. term of decoupling. The Commission was happy when Joe Biden and other Americans agreed that this would be a better term. But it doesn’t change – we all know – what it means.

And of course, this does something with people. If you are thinking of investing in China, if you are thinking of investing in the region – maybe not in China, but in the region in general – you think twice. So we are much more careful than you would have been before.

If you look at the numbers, yes, it’s true that the FDI has grown, but the decisions were taken a couple of years ago. Decisions taken this year will be seen in the figures a couple of years from now. So I think there will be some downward data.

In the end, I think it’s absolutely important that we see the full picture of risks. And I found it very important – you mentioned, Dr. Wang – that China was not at the center of the Munich Security Conference because there are so many other problems, so many other challenges. And if you look at these challenges, most of them we can only tackle jointly. And if we miss this opportunity to work jointly on these issues, we will all lose.

I’m not very happy with Christoph Heusgen’s choice of the motto of the Security Conference, “Lose-Lose?”, because many oversee the question mark. And in the end, it’s really a lose-lose if we continue the path which some are currently looking after. Globalization has been much faster than the growth of global GDP, and now it’s more or less in sync. This is good that globalization is not stopping, but it’s slowing down.

And some of the reasons can be explained – the pandemic; we have seen the container carriers stuck in the Suez Canal, which had effects on German manufacturing plants; we see now the peacemaking transport via the Red Sea more difficult and more costly. If you go there anyway, the insurance prices are going up; If you don’t go there, you have to go around Africa. Both ways, prices are going up. So we see already that there are many risks.

I mentioned it already a couple of times that as China is playing a bigger role in the Middle East, having brought together Saudi Arabia and Iran, many look to China now to use their influence on Iran and the Houthis not to destroy the sea lines of communication via the Red Sea.

So if you look at the big picture, yes, we have to realize that there are many more risks and many more challenges that we only can tackle together. And as some others mentioned here, it depends on where you are, what you do, where you come from, where you see your risks. Of course, for some, China might be a risk. But for others, the U.S. is to risk. And for, again, others, the risk is somewhere else. I think I should stop here.

Henry Huiyao WANG

Thank you, Ambassador Kreft. Very good. I agree with you. De-risking is really misleading, but you are a veteran [ambassador], a participant of the Munich Security Conference and you see the atmosphere. Your observation, your comment is very valuable. So thank you again.

I think we’ve probably – given the time – come to the first roundtable’s conclusion, but we still have a second roundtable. We have a senior representative from Nio, which is a star company in China. And also we have TikTok, we have many German companies that haven’t had a chance to talk. So we would like to maybe have a five-minute break and then we continue a second round of exciting discussion.

So thank you very much. I think from the think tank point of view, we have learned a lot. We appreciate your frank comments. I would take good notes and we like to share that with our colleagues back home. So thank you all very much. This is really very stimulating, very informative, and very helpful for us to understand better the real feelings between the business communities of both China and Germany. Thank you very much.