CCG Releases Talent, Innovation and Industry Chain Resilience Report 2023 at the Import Expo

November 06 , 2023

On November 6, 2023, the Center for China and Globalization (CCG) released the Talent, Innovation and Industry Chain Resilience Report 2023 (hereafter Report 2023)at the sub-forum on “Enhancing the Resilience of the Global Industry Chain Supply Chain” of the 6th China International Import Expo (CIIE) and Hongqiao International Economic Forum (HIEF). The report was drafted and compiled by CCG, a think tank partner of Hongqiao International Economic Forum of the Import and Export Fair.

The Report 2023 selects five primary indicators and 22 secondary indicators, including Talent Capital, Innovation Resources, Overall Industrial Situation, Manufacturing Performance and Enterprise Vitality, to construct a “national industrial chain resilience index” (NICRI). Based on the NICRI ranking, the report analyzes the international ranking of the industrial chain resilience of 38 economies, including China, the United States, Canada, the United Kingdom, France, Germany, Australia, New Zealand, Japan, South Korea, Singapore, and India, as well as the contribution of talent capital, innovation resources, overall industry situation, manufacturing performance, and enterprise vitality to each country’s industrial chain resilience. The report focuses on China’s performance on the five indicators and takes the new energy automobile industry and semiconductor industry as case studies to analyze the impact of talent and innovation on the resilience of the relevant industrial chain. The report explores the role of talent and innovation in enhancing the resilience of industrial chains through data analysis and provide reference for jointly constructing a global industrial chain system that is safe, stable, smooth and efficient, open and inclusive, and mutually beneficial and win-win.

The results show that Asian economies’ industrial chain resilience are impressive, and with its comparative advantages, China performs well in applying science and technology innovation to drive the rapid development of the manufacturing industry, manufacturing industry, the overall situation of industries, and business vitality. In terms of talent capital, however, China is in a weak position, and its investment into innovation is still insufficient. The resilience of the industrial chain of China is faced with the challenge and the report puts forward five recommendations to enhance the resilience of the industrial chain.

The following are the key points of the Talent, Innovation and Industry Chain Resilience Report 2023:

The resilience of industrial chain of major countries in the world vary differently, and the performance of Asian countries are outstanding.

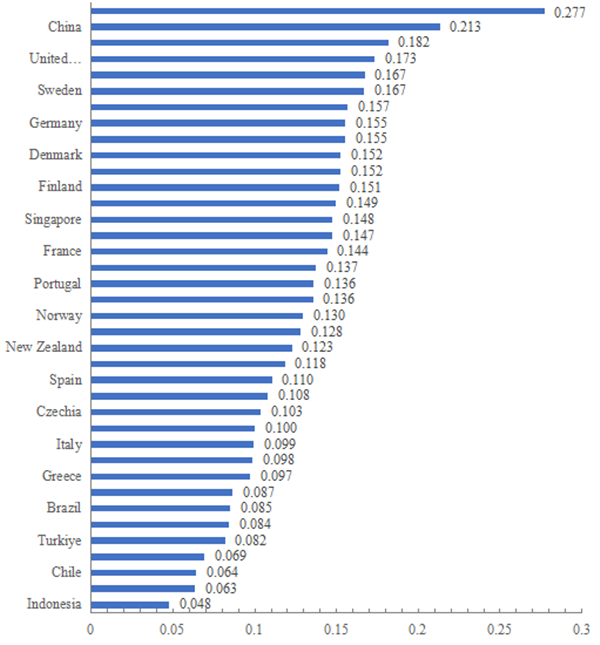

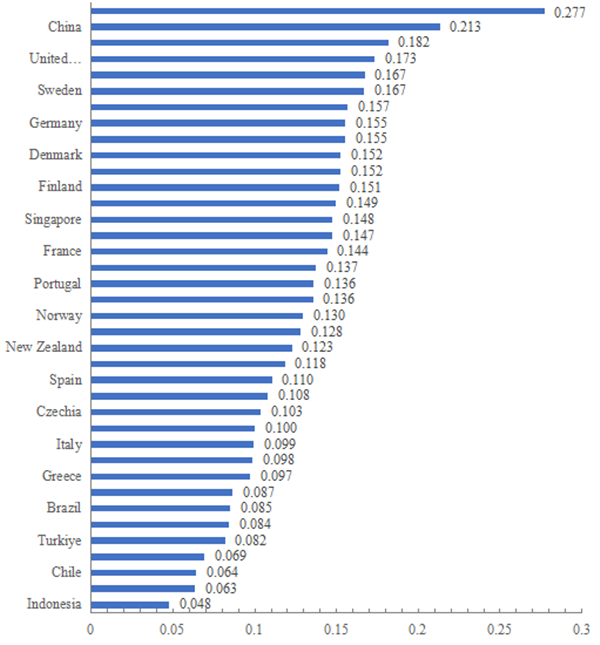

The report shows that the industrial chain resilience of the world’s major countries can be divided into several tiers based on their NICRI ranking. The first tier is the top ten countries. The U.S. is leading significantly, and the gap with the second place China is significant, the U.S. score is 1.2 times than China. Germany, Japan, and Singapore are ranked third through fifth, with scores between 0.35 and 0.38; the three countries perform equally well, but the gap with the United States is even more pronounced, with scores just over half that of the United States. The sixth to tenth place of South Korea, Britain, Sweden, Israel, France’s index score between 0.3-0.35. In the top ten, there are five European and American countries and five Asian countries, showing that the industrial chain of Asian countries are also resilient.

Ranking 11th to 17th Canada, Belgium, Denmark, Switzerland, Ireland, Finland, Austria and other 7 European and American countries are in the same tier, with scores between 0.25 and 0.3. The 7 countries ranked 18th to 24th, including Australia, Spain, Norway, Czech Republic, India, Mexico and Portugal, are in the third tier, with a score between 0.23 and 0.24. Ranked 25th to 30th, Malaysia, Poland, Russia, Italy, Saudi Arabia, the Netherlands and other 6 countries are in the fourth tier, with scores between 0.2 and 0.22. Turkiye, Brazil, New Zealand, Greece, South Africa, Indonesia, Argentina, and Chile, ranked 31st to 38th, are in the bottom 8, with the index between 0.13 and 0.2. The industrial chain resilience index of the countries in the last three tiers do not differ much. However, the industry chain resilience index of the top-ranked U.S. is 5.4 times higher than that of the bottom-ranked Chile.

Figure 1 Rankings for Talent Capital and Innovation Resource for 38 Countries

China has obvious advantages in manufacturing performance, overall industry situation and enterprise vitality, but it is temporarily weak in terms of talent capital, and the investment in innovation still needs to be strengthened, and the resilience of China’s industrial chain still faces challenges.

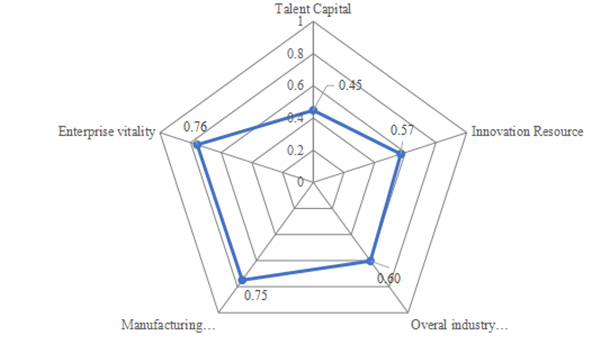

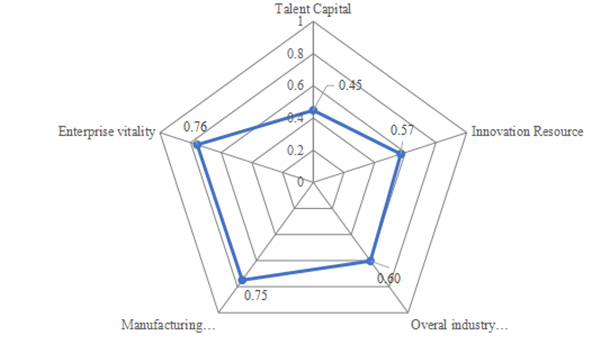

From the overall ranking of NICRI, China ranks second, after the United States, which is comparable to China’s economic volume in the world. In terms of the scores of each primary indicator, calculated on the basis of a full score of 1 for a single indicator, China scored the highest in the Enterprise Vitality, with a score of 0.76; followed by the Manufacturing Performance, with a score of 0.75, and then the Overall Industrial Situation (0.60), Innovation Resources (0.57), and Talent Capital (0.45). From the perspective of the ranking of each indicator, the Manufacturing Performance indicator ranks first, the Overall Industry Situation, Enterprise Vitality, and Innovation Resources all rank second, and Talent Capital ranks seventh.

Figure 2 China’s Industrial Chain Resilience Index Performance on Primary Indicators

In terms of Manufacturing Performance, China holds the top position. This is particularly evident in the Added in Manufacturing indicator, where it ranks first. Additionally, the indicators Proportion of Value Added in Medium and High-Tech Manufacturing to Total Manufacturing Value Added and Proportion of High-End Manufacturing Exports to Total Manufacturing Exports rank 22nd and 15th, respectively, indicating that China’s manufacturing sector exhibits significant advantages in the midstream of the industrial chain. However, there is still room for development in the upstream of the industrial chain. At present, China’s manufacturing sector encompasses a wide array of industries and offers a diverse range of products. While maintaining its existing strengths, China should focus on developing high-end manufacturing to accelerate its transition to higher value-added manufacturing.

In terms of Overall Industry Situation, China ranks second, just behind the United States. Among them, China ranks second and first in the indicators of Gross Domestic Product and Total Value of Goods and Services Exports respectively, reflecting China’s overall advantage in the entire industrial chain. In addition, China’s performance in indicators related to foreign investment is notable. China ranks first in both Foreign Direct Investment Inflows and Foreign Direct Investment Outflows, which shows that despite the serious impact of the COVID-19 global pandemic in 2020, China’s relatively stable domestic environment has provided significant advantages in attracting foreign investment and outward investment. Moreover, the indicators Growth Rate of FDI Inflow in 2020 and Growth Rate of FDI Outflow in 2020 are both positive, suggesting that China maintained positive growth in both FDI inward and outward in 2020. These two indicators rank ninth and seventh, respectively, underscoring the stability of China’s industrial development.

In terms of Enterprise Vitality, China is ranked second, just behind the United States. China performs particularly well in the Number of Unicorn Enterprises indicator, where it ranks second, and its score in this category is twice that of all countries ranked third to thirty-eighth. What’s more, China ranks fifth in the Number of New Registered Companies Annually indicator, reflecting its strong market dynamism. However, there’s room for improvement in China’s Ease of Doing Business Score indicator, where it ranks 19th. This indicates that China can further optimize its business environment.

In terms of Innovation Resources, China ranks second, just behind the United States. China excels in the Total Patent Grants and Number of Scientific and Technical Journal Papers indicators, where it is ranked first, indicating China’s quantitative advantage in technology output. However, China’s rankings are relatively lower in the indicators of Researchers Per Million Inhabitant, FTE (29th) and R&D Expenditure as A percentage of GDP (14th), and Top 1000 University Rankings (5th).

In terms of Talent Capital, China is ranked seventh and going through a temporary period of vulnerability. On one hand, this is related to China’s relatively low investment in public education, with a rank of 33 in the indicator Public Education Expenditure as a Percentage of GDP. On the other hand, it is also associated with China’s large population base of labor force. Specifically, China’s performance is not strong in indicators related to per capita proportion, such as Labor Productivity and Proportion of the Labor Force with Higher Education, with rankings of 36th and 28th respectively.

China’s industrial chain resilience ranks at the forefront globally, primarily due to China’s possession of the world’s largest market and the most comprehensive industrial chain structure. In recent years, China has vigorously supported the high-quality development of its industries by filling gaps in the industrial chain, upgrading traditional industries, and establishing emerging industrial chains. This has enhanced the stability and competitiveness of industrial development. For instance, to upgrade traditional industry chains, China has accelerated the integration of outdated production capacity, driven the transformation of traditional industries, and promoted their advancement towards high-end, intelligent, digital, and green development. This has significantly reduced production costs and improved production efficiency. Regarding the establishment of new industrial chains, China has leveraged its resource endowments and market advantages to optimize the layout of emerging industries such as new energy vehicles and next-generation information technology, thereby fostering stable development in these sectors. Supported by a robust existing infrastructure, China’s industrial chain is solid and robust, demonstrating considerable resilience in the face of changing international circumstances.

Suggestions: five measures to enhance the resilience of the industrial chain

First, uphold openness and cooperation to jointly safeguard global industrial chain resilience. Enhancing the ability of the global industrial chain supply chain to cope with risks by promoting openness and cooperation has been the main path and purpose of China’s economic exchanges and external cooperation in recent years, and it is also a feasible program to enhance the resilience of China’s industrial chain supply chain. At present, the global supply chain has seen a trend of “fragmentation”, which poses a challenge to the global industrial chain and production division of labor system. In this regard, China needs to initiate more open and equal international cooperation to ensure that all economies enjoy equal opportunities in the global industrial chain. On the one hand, make full use of or create cooperation platforms and mechanisms to deepen international cooperation, promote the sharing of knowledge, technology, talents and other aspects of resources, eliminate the information and technology divide, reduce the cost of sharing, and improve the efficiency of cooperation; on the other hand, build a consensus and crystallize the consensus into actions and rules to reduce the uncertainty faced by the global industrial chain supply chain.

Second, establish a communication platform for industrial chains resilience and a regularized communication mechanism. Establish a regularized global industrial chain supply chain resilience exchange dialogue and cooperation mechanism to promote information sharing among industrial chain participants in different links, facilitate resource and experience sharing, strengthen technological innovation and risk management, and enhance mutual trust. Specifically, (1) provide a platform for information sharing and cooperation, share practical experience, and empower countries to jointly address challenges; (2) provide opportunities for technological innovation and collaborative R&D, so that different countries and enterprises can pool and integrate innovative resources; (3) establish a platform for coping with common crises and risk management, and help countries to jointly formulate strategies for coping with emergencies; (4) promote sustainable development of the global industrial chain and explore technologies and business models related to sustainable development, such as environmental protection and emission reduction; (5) build mutual trust and promote a better understanding of each other’s positions and interests.

Third, drive the integrated development of the innovation chain, talent chain, funding chain, and industry chain. The “four-chain integration” does not only refer to the integration of a single industry or sector, but also the integration in the unified domestic market, with the intention of building a perfect ecosystem with full flow of factors and safeguarding the security and resilience of strategic industries in an inclusive manner. Specifically, (1) optimize innovation support policies such as finance, taxation and intellectual property protection to guide enterprises and social capital to actively invest in R&D and innovation activities and increase the intensity of R&D investment. (2) Strengthen talent cultivation and mobility; upgrade the level of education, strengthen education in STEM fields, and intensify the cultivation of talents; carry out skills training and vocational education to enhance the technical level of talents; encourage the clustering of talents, and smooth the channels for the mobility of talents across regions, fields, and sectors. (3) Promote two-way interaction between science and technology and industry and strengthen the accumulation and creation of industrial practices. (4) Break down institutional barriers and better utilize the coordinating role of the government in the collaborative development of education, science and talent. (5) Break through the institutional barriers in the process of “four-chain” integration, innovate the collaboration mechanism, incentive model and assessment and evaluation system, and enhance the sense of achievement of the main chain participating in the integration.

Fourth, enhance digital transformation to improve the predictability and adaptability of the industrial chain. Digital transformation plays a crucial role in modern industrial development, which can not only improve efficiency and productivity, but also improve the level of intelligence in innovation, production and supply management, enhance the predictability of the industry chain, and cope with the changing market environment and emergencies, so as to enhance the stability and resilience of the industry chain. Specifically, (1) strengthen the construction of digital infrastructure to ensure high-speed Internet connectivity and data storage capacity in support of digital transformation; (2) build the capacity of data collection, analysis and application in the industrial sector, and assist scientific decision-making with data analysis; (3) promote the application of technologies such as the Internet of Things (IoT) to enhance real-time monitoring of equipment and systems and the digitization of supply chain management, so as to realize real-time visualization of the supply chain and increase the Supply chain flexibility; (4) enhance cybersecurity to reduce potential cyberattacks and the risk of data leakage; (5) enhance digital training and skills upgrading of talents to ensure that they adapt to the digital transformation environment.

Fifth, improve the market environment with effective macroeconomic policies and strengthen China’s weak links in key industries. In recent years, in order to safeguard the development of strategic industries, China has implemented strategic guiding to relative industries with efficient monetary and fiscal policy support. In the future, in solving the problem of “bottleneck” strategic links, in addition to guidance through monetary policy and fiscal policy, we need more actions from the legislative aspect. On the one hand, to strengthen the implementation of effective rule of law protection of strategic industries; on the other hand, through the creation of market-oriented, rule of law, international first-class business environment, optimize the environment for the development of private and foreign-funded economy, the protection of the property rights of private enterprises and entrepreneurs in accordance with the law, all kinds of ownership of the economy in accordance with the law, equal use of factors of production, and fair participation in the market competition, in order to better link the research and development, commercialization, production and distribution of the strategic industries.

Keyword