Situation in Venezuela serves as warning for overseas investment

August 08 , 2017

The continually worsening social and economic conditions in Venezuela have reinforced fears that the oil-rich country, once the wealthiest in Latin America, could be on the verge of a civil war.

This could well put China’s massive commitments to the country at stake, and it should serve as a wake-up call for more rigorous evaluation of the uncertainties and risks involved in investing beyond the Chinese mainland, particularly along the route of the “Belt and Road” (B&R) initiative, which includes some volatile countries and regions.

China should not just put irrational overseas acquisitions in the crosshairs, which it is already doing to guard the nation against systemic financial risk, but should give higher priority to political risk assessments, which are crucial for China to safeguard its overseas investment.

Projects in political risky and unstable countries could present unexpected challenges. Abrupt deterioration of the political situations in these countries could easily turn investments into bad loans. Therefore, security threats in certain parts of the world should be considered thoroughly before investment is made in these areas.

Chinese businesses already cite political risk as the top concern in investing abroad.

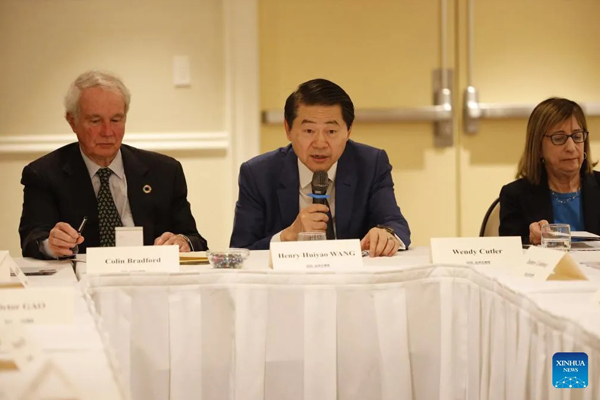

A survey of 300 Chinese companies by the Center for China and Globalization(CCG), a Beijing-based think tank, showed in November that more than 70 percent of the respondents selected political risk factors such as policy changes and political unrest as their top concern about investment beyond the home turf.

It’s not enough for Chinese businesses to raise their awareness of the need to measure political risks before investing in politically unstable markets. There should also be ramped-up efforts by the Chinese government to improve the evaluation of potential pitfalls of investing in politically turbulent countries.

In the case of Venezuela where China’s policy banks, notably the China Development Bank, have made huge commitments, the situation in the South American country would be of less concern if Chinese regulators had conducted a thorough evaluation of the risk involved in continuing to put money into the country and issued investment warnings accordingly.

With China actively pushing for investment along the route of the B&R, which encompasses more than 60 countries and regions, some of which are politically unstable, it is all the more important for Chinese businesses and regulators to evaluate their efforts to insulate overseas investments from political risk.(By Xiao Xin)